Oban provides a solution for the reliable and secure transport of messages of any type.

SuperStream Payments

The introduction of Digital Currency has breathed new life into the SuperStream Payments world. Digital Wallets see the removal of the dependency on intermediary bank accounts, and because Oban is notified when the Fund-linked Member Wallets receive Digital Currency, reconciliation of the payment & data is performed BEFORE the CTR message is sent to the Registry. This allows the Fund's registry provider to confidently allocate contributions to Members immediately upon receipt of the CTR message.

A process that usually takes many days can now be performed in a matter of minutes.

For all the benefits, SuperStream still has two major pain-points:

- SuperStream never successfully addressed the Employer end of the pipeline (which saw the proliferation of clearinghouses in an attempt to address this gap)

- Payment & data travels down two separate pipelines causing time-consuming reconciliation at the Registry end

Oban's approach addresses both pain-points by:

- Cutting out intermediary bank accounts thus minimizing counterparty risk

- Reducing the Registry processing burden by removing the reconciliation step. This will assist in handling the additional volume generated by the introduction of Payday Super.

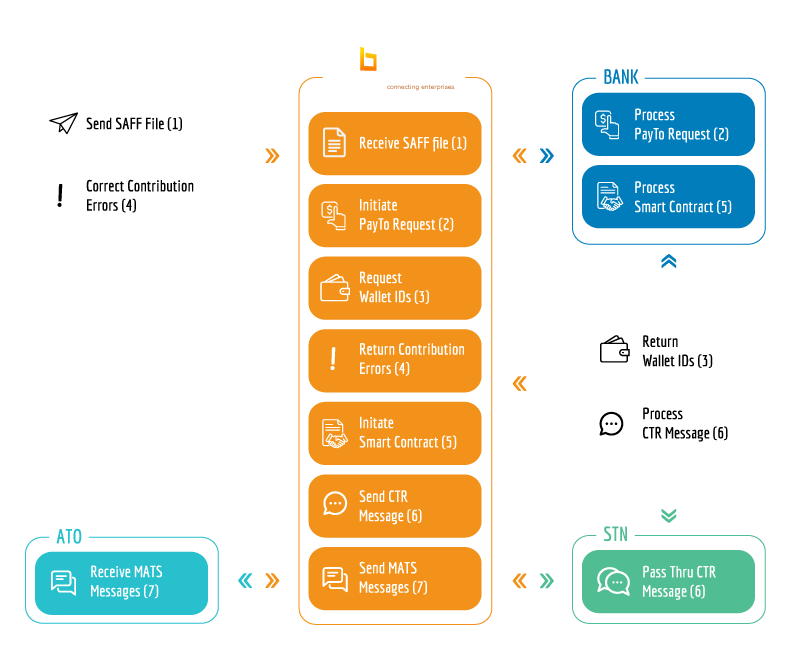

In order to populate the Employer Wallet, once a SAFF file is received by Oban, a NPP PayTo (real-time direct debit) call is made requesting the required amount be debited from the Employer's bank account. The beauty of this solution is that it brings together the two latest payment technologies, the NPP and Digital Currency.

It's important to note that this is an enhancement to the well established SuperStream network, so we have named the solution SuperStreamPlus.

Member Wallets

It would be the Registry provider's responsibility to commission/maintain the Member wallets via API calls (i.e. when a new entrant is processed, the Registry provider will create a Member wallet; when a member exits, the wallet would be flagged as inactive).

When an Employer/Payroll provider sends a SAFF file to initiate the contribution processing cycle, Oban will call the smart contract that will populate the Member wallets, guaranteeing the contribution will hit the members' account. This avoids contributions being left in limbo whilst the administrator tries to resolve the member mismatches. Noting that if these mismatches can't be resolved after a legislated period of time, the corresponding contributions are required to be sent back to the Employer.

Typically, a member mismatch is due to the following:

- Member has rolled over to another Fund without telling their Employer

- The Member hasn't been set up because of an error in the MRR message

- The Employer has paid into the wrong Fund

- The CTR message is processed before the MRR message

Importantly, these errors are reported to the Employer in near real-time allowing them to correct and resubmit the data the same day, again via an amended SAFF file.

Interestingly, because it's guaranteed the contribution will be allocated to the members account when a Member wallet is transacted, a MATS message can be sent to the ATO in real-time.

Contribution Tax Wallet

During the setup process a Fund level Contribution Tax wallet will be created. This wallet will include the all the contribution tax amounts broken down by member that relate to SuperStream payments. It is then the responsibility of the Fund to pay the ATO, typically, at the end of the month. Importantly, the ATO will be able to report member contribution tax liabilities prior to receiving the tax payment from the Fund by interrogating the wallet at any time.

Notably, if the Fund Contribution Tax wallet was replaced with an equivalent ATO Contribution Tax wallet, it is feasible the ATO could receive contributions tax at the same time the Members receive their contributions.

Fund Reporting

Designed for the Fund marketing department, this is a statistical report broken down by the following:

- Employer ABN

- Fund (includes all Funds the Employer is contributing to)

- Age Band

- Gender

- Employment Status (Full-time, Part-time, Casual)

- Contribution Amount